In early December, we received word of Bloomberg News’ foray into the sports world. The early news featured discussions of how Bloomberg would use its successful financial analytical tools to bring fantasy sports products to the baseball world. Today, Bloomberg is debuting its product, and Joe and I are now at Bloomberg HQ watching their presentations. You can follow along with us via the RAB Twitter feed, and all of the presentations’ participants are Tweeting via the #BBGsports hashtag.

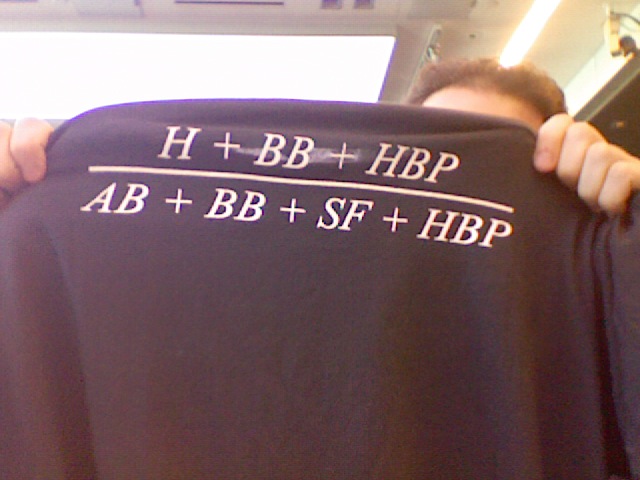

We’ll have a full write-up of the offerings over the next few days. I’m waiting on some screenshots in order to introduce the product’s features. From the early demo, it looks very good, and Bloomberg Sports seems serious about responding to reader feedback as they work to make the product more useful and user-friendly. As you can see from the above photo, the swag is pretty sweet too.

Leave a Reply

You must be logged in to post a comment.