A recent profile of track prodigy Galen Rupp and his coach, former marathon champion Alberto Salazar, noted that it’s been forty-eight long years since an American man won an Olympic medal at the 10,000 meter distance. Salazar believes that Rupp, his twenty-five year old student of 12 years, can end that drought this summer in London. Rupp is an extremely talented runner, one of the best at the 5 and 10k distances, but both Salazar and Rupp know that besting the dominant Africans at this distance would require virtually everything to go right. And so they’re doing their best to ensure that it does. “The mantra is control the controllables,” explains Nike’s sports psychologist, Darren Treasure.

“”We’re not at all intimidated by the Africans; they’re great runners but there’s so many of them. With our [American] runners, we have so few of them that we have to do everything perfect,” says Salazar…

Since 2001, Salazar has ensured that his small crop of Oregon Project runners have access to every technological, physiological and psychological advantage available. From altitude simulation tents and rooms to both anti-gravity and underwater treadmills to the Cryo Sauna, a cylindrical chamber that turns liquid nitrogen to gas to cool an athlete’s body at bone-chilling temperatures for rejuvenating purposes, Nike, who reported revenues of $19 billion in 2010, pays for and houses them on their 193-acre Beaverton, Ore., campus.”

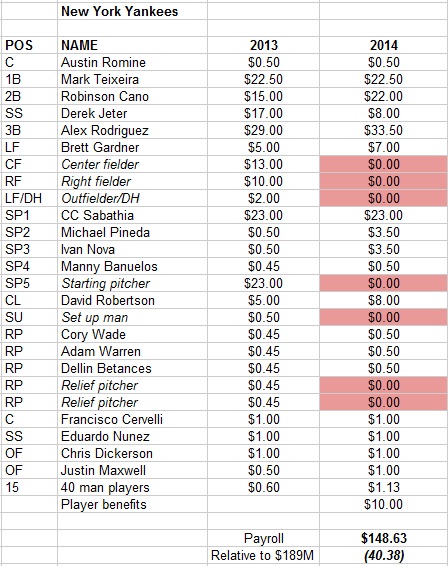

So what do Cryo Saunas and altitude simulation tents have to do with Yankee prospects? The Empire State Yankees, the AAA affiliate of the New York Yankees, are currently without a home stadium. The Yankees are in the process of tearing down the old PNC Field and replacing it with a $40M facility, but in the interim the club has nowhere to call home. This means that players like Manny Banuelos, Dellin Betances, Francisco Cervelli and Austin Romine will be spending the entire season on a 142 game road trip, playing “home games” in six different cities. The hope is that the stadium will be completed in time for the 2013 season, but 2012 will be a tough order for these Yankee minor leaguers.

This is a more extreme example of the grind of minor league life, detailed in depth by Mike Ashmore here. While the facilities at the major league level are top notch, players just below that level often deal with situations that wouldn’t be suitable for elite athletes in other sports. Of course, plenty of these athletes are not elite, and the lion’s share of them won’t ever become major league regulars. Regardless it’s not a stretch to say that the nutrition opportunities in particular for players at the minor league level do not come close to that of an Olympian or a major leaguer. I asked Josh Norris, beatwriter for the Trenton Thunder, about the food habits of the players he covers:

“The per diem is certainly meager, and the postgame spreads aren’t exactly Jenny Craig approved… Fast food is the only available option a lot of the time, but they can obviously choose, say, Subway over McDonald’s. A personal chef/nutritionist would obviously be helpful, but for 30 guys on the road and at home would get really, really complicated.”

Norris went on to astutely note that an in-shape ball player isn’t always the superior ballplayer:

“A perfect example is a guy like Richie Robnett. With his shirt off, that guy was a Met-Rx commercial waiting to happen. At the plate, however, his washboard abs rarely translated into solid contact. Contrast that with a guy like, say, Prince Fielder, who obviously isn’t the picture of health. If you went in with no knowledge of the players other than their appearance and perceived health/strength, you’d take Robnett every time. Being a successful baseball player requires much more than pristine physical fitness. There’s coordination, adherence to practice regimen, and, on some level, I think, superior genetics.”

Given that prime nutritional health and peak baseball performance aren’t perfectly correlated, and given that most of these players have little ultimate value to the major league team, what’s the impetus to spend more money to institute a more rigorous exercise and nutrition program? New, advanced technologies don’t always translate directly into improved baseball skills. Maybe there isn’t a smart, snappy answer to these questions. But these players are athletes, and we don’t know what sort of talent and skill is left underdeveloped when they aren’t given every chance to become the greatest they can be.

Do the Cryo Saunas mean that Rupp recovers better from his hard workouts and gets faster, leading to one or two seconds gained on the track? Would he have been that fast if he had just used ice? You can’t know. But when there’s so much at stake, and so much money to be made (especially in baseball), it would seem prudent to take every avenue possible to maximize the value of your players. They may not need Cryo Saunaus, but ensuring that every minor leaguer in the Yankees organization gets the best nutrition and workout facilities available to them might lead to an organizational advantage and a more efficient development of talent. If I were the owner of a team and had some extra cash lying around, perhaps leftover thanks to new restrictions on how much I can spend on the draft, I might see if this would be a worthy investment.